China’s Spring Festival box office has once again demonstrated why the Lunar New Year corridor is one of the most powerful theatrical windows in the world, with Pegasus 3 emerging as the clear frontrunner of the 2026 holiday frame. The racing-themed sequel, directed by Han Han and starring Shen Teng, has surged past 1.29 billion yuan within days of release, setting the tone for a holiday period that is delivering hundreds of millions of dollars in revenue across the country.

According to official data reported by Chinese state media and ticketing platforms, total revenue during the 2026 Spring Festival period had already surpassed 2.53 billion yuan (approximately $366 million) by mid-holiday, with momentum continuing to build as families flocked to cinemas across the country. The Spring Festival stretch, which typically runs around nine days and overlaps with peak travel and family gatherings, has become a defining revenue engine for China’s annual theatrical performance.

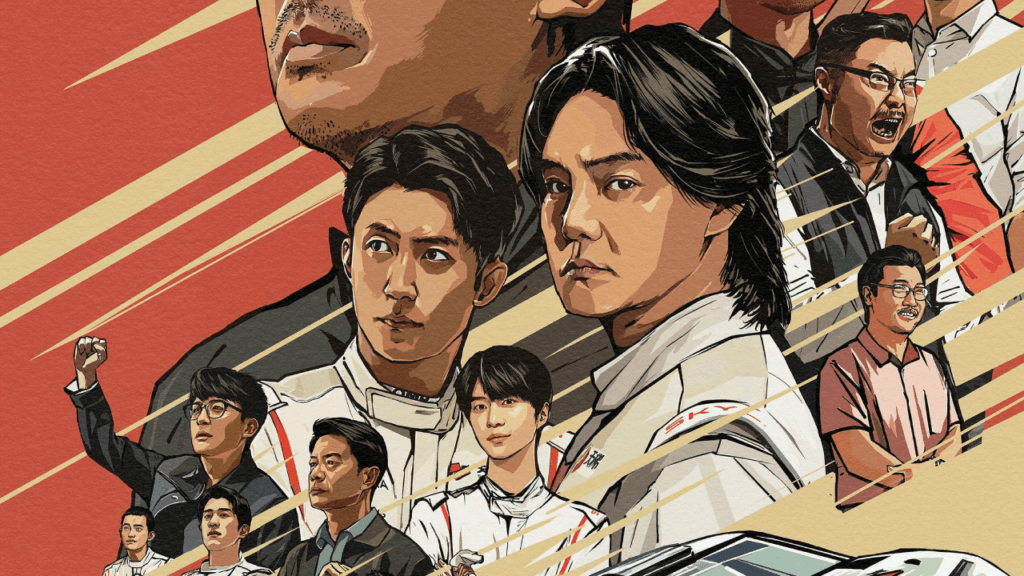

This year’s slate reflects a diversified market rather than reliance on a single breakout title. Leading the pack is Pegasus 3, directed by Han Han and starring Shen Teng. The racing-themed comedy has emerged as the clear frontrunner of the holiday frame, crossing 1.29 billion yuan in box office revenue within days of release, according to tracking data cited by outlets including Global Times. Strong presales and broad demographic appeal have positioned the film as one of the year’s early blockbusters, with some projections suggesting it could ultimately surpass 5 billion yuan in total gross if momentum holds.

The franchise’s continued strength underscores the appeal of high-concept domestic tentpoles during the holiday window. Racing dramas and sports-driven comedies often blend spectacle with family-friendly storytelling, making them ideal for multi-generational audiences. Analysts have noted that Pegasus 3 appears to be drawing viewers across age groups, including significant turnout from smaller cities beyond China’s largest metropolitan hubs.

Close behind is Scare Out, an espionage thriller directed by acclaimed filmmaker Zhang Yimou and starring Jackson Yee and Zhu Yilong. Positioned toward adult audiences, the film adds genre variety to the holiday mix and reflects ongoing appetite for national security and suspense narratives. While early grosses trail behind Pegasus 3, the film has secured a solid second-place ranking in daily charts and remains one of the season’s major commercial players.

Animation continues to be a crucial component of the Spring Festival formula. Bonnie Bears: The Hidden Protector, part of a long-running animated franchise that reliably performs during the Lunar New Year period, has posted strong numbers as families seek child-friendly options. The consistent performance of animated titles during the holiday demonstrates the importance of offering broad-based programming that caters to parents and children alike.

Action and martial arts fans have also been drawn to Blades of the Guardians: Wind Rises in the Desert, which features Wu Jing and Jet Li. The film blends period spectacle with high-intensity combat sequences, targeting younger adult audiences while benefiting from the star power of established action icons. Meanwhile, family-oriented adventure titles such as Panda Plan: The Magical Tribe, headlined by Jackie Chan, continue to contribute to overall holiday earnings and reinforce the importance of multi-genre competition.

Industry observers have highlighted that presales for the 2026 holiday season crossed major milestones well before the official opening days, signaling strong consumer anticipation. Unlike some previous years where one title overwhelmingly dominated the frame, this year’s lineup appears more evenly distributed across several films, creating what analysts describe as a “multi-power” box office landscape.

Last year’s Spring Festival window generated nearly 9.5 billion yuan (around $1.36 billion), making it one of the most lucrative holiday frames on record for China. Whether 2026 will reach similar heights remains uncertain, but early indicators suggest robust audience engagement. The Lunar New Year corridor has historically served as a bellwether for the strength of China’s theatrical market, often setting the tone for annual box office performance.

The structure of the holiday period also gives domestic productions a strategic advantage. Hollywood films are generally not permitted to open during the core Lunar New Year stretch, ensuring that locally produced titles command maximum screen availability and marketing attention. While previously released imports may continue screening, the absence of major new foreign releases allows Chinese films to capture concentrated demand.

Beyond ticket sales, cinema-going during Spring Festival has become embedded in broader holiday culture. Reports indicate that film-related travel, retail tie-ins and themed events contribute to a wider ecosystem of consumer spending. In recent years, going to the movies has become as much a social ritual as a form of entertainment during the New Year celebration.

China’s performance during this window also reinforces its significance within the global box office hierarchy. While North America and other territories distribute revenue more evenly across the calendar year, China’s Spring Festival offers a compressed, high-intensity earning period capable of generating hundreds of millions of dollars in a matter of days.

As 2026 unfolds, the strong early returns from Pegasus 3 and its competitors suggest that domestic audiences remain eager for theatrical experiences built around spectacle, star power and culturally resonant storytelling. Whether this year’s final tally rivals the historic highs of previous seasons will depend on sustained momentum in the days ahead. For now, however, China’s Lunar New Year box office once again stands as one of the most formidable theatrical forces in the world.

Read More: