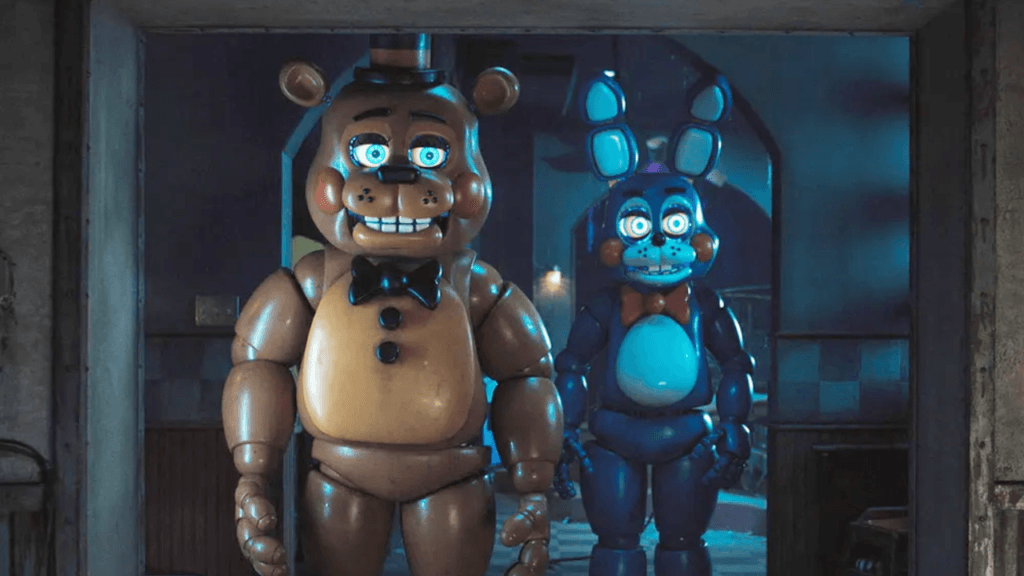

Audiences poured back into Freddy Fazbear’s Pizza in overwhelming numbers, jolting what is typically a quiet post-Thanksgiving frame into a genuinely robust theatrical weekend. Universal’s Five Nights at Freddy’s 2 easily claimed the domestic crown with a muscular $63 million debut, outperforming projections that had pegged the sequel in the $35–40 million range. While that opening trails the $80 million start of the first film in 2023, the original’s unusual day-and-date Peacock launch makes the sequel’s traditional theatrical performance all the more significant.

For Universal and horror powerhouse Blumhouse–Atomic Monster, the result lands as a timely and badly needed win. After an uneven 2025 marked by underperformers such as M3GAN 2.0, Wolf Man, and Drop, the studio partnership appears to have steadied its footing following Black Phone 2 and now Five Nights at Freddy’s 2. Produced on a controlled $36 million budget, the sequel is already firmly in profit territory. Josh Hutcherson, Matthew Lillard, Elizabeth Lail, and Piper Rubio reprise their roles under returning director Emma Tammi, as the franchise once again taps into its devoted Gen Z audience. Internationally, the film added an estimated $46 million from 76 markets, lifting its worldwide total to $109 million in just days. The message for Hollywood remains clear: video game adaptations continue to be one of the most reliable youth-driven theatrical draws.

Disney’s Zootopia 2 ceded first place after dominating the Thanksgiving holiday but remained a formidable challenger in second, collecting a hefty $43 million. With $220.5 million earned domestically to date and a staggering $915.8 million worldwide, the animated sequel is now all but assured to cross the $1 billion mark globally, solidifying Disney’s family-animation stronghold as the year winds down.

Universal also held third place with another high-profile sequel, Wicked: For Good, which added $15.6 million in its third weekend. The musical follow-up has amassed $295.8 million domestically, confirming its status as one of the most durable theatrical performers of the season and a key stabilizer for exhibitors navigating an otherwise uneven Q4.

In fourth place, GKIDS scored one of the weekend’s standout specialty victories with Jujutsu Kaisen: Execution. The anime compilation debuted to an impressive $10.2 million, underscoring both the drawing power of the franchise and the growing consistency of anime releases in North American multiplexes. The success reinforces how eventized anime titles can punch far above expectations when properly timed and marketed.

Lionsgate’s Now You See Me, Now You Don’t rounded out the top five with $3.5 million, pushing its domestic total to $55.3 million. While far from franchise highs, the performance reflects steady legs amid heavy competition.

Beyond the top tier, the specialty market offered notable signals. Sony Pictures Classics debuted Merrily We Roll Along, a filmed presentation of the acclaimed Stephen Sondheim Broadway revival, to $1.2 million from 1,084 screens—respectable numbers for a prestige theatrical capture led by Jonathan Groff, Daniel Radcliffe, and Lindsay Mendez. Bleecker Street’s Fackham Hall, a broad parody of period dramas, opened to $620,909 across 1,112 locations, modest but in line with expectations for the genre play.

One of the more compelling platform stories belonged to Focus Features’ Hamnet, which expanded aggressively from 119 theaters to 744 and earned $2.3 million. With a domestic total now at $4.2 million, the Shakespeare-inspired drama is gaining traction as awards season converges, positioning itself as a potential Oscar player.

Also drawing attention—both for its novelty and nostalgic appeal—was Quentin Tarantino’s marathon reissue Kill Bill: The Whole Bloody Affair. The four-and-a-half-hour combined cut grossed an estimated $3.25 million, a noteworthy figure for a repertory-style release and further evidence that premium-event screenings can still mobilize cinephile audiences.

For theater owners, this weekend offered cautious optimism. After a difficult autumn filled with high-profile stumbles, holdovers like Wicked: For Good and Zootopia 2, paired with strong new entries such as Five Nights at Freddy’s 2, are helping steady foot traffic. Even so, the wider picture remains mixed. Domestic box office revenue currently sits only about 1% ahead of 2024, falling short of expectations that 2025 would mark a more decisive recovery toward pre-pandemic norms, when annual ticket sales routinely exceeded $9 billion.

Industry anxieties were further amplified this week by seismic corporate news surrounding Netflix’s agreement to acquire Warner Bros. for $82.7 billion. The potential reshaping of Hollywood’s power structure has exhibitors questioning the long-term theatrical commitments of streaming-first conglomerates. As one analyst put it, the fear is less about ownership and more about intent—whether movies will continue to be meaningfully prioritized for theatrical release.

As December accelerates toward its holiday corridor, exhibitors are banking on upcoming tentpoles such as Avatar: Fire and Ash to carry sustained momentum. This weekend proved audiences will still show up in force—provided the content truly connects.

Note: Box office numbers are subject to change

Read More: