Sony has taken a decisive step toward consolidating control over one of the most enduring brands in global pop culture. Sony Pictures Entertainment and Sony Music Entertainment (Japan) have entered into a definitive agreement with Canadian media company WildBrain to acquire the 41% stake WildBrain holds in Peanuts Holdings LLC, effectively giving Sony majority ownership of the beloved Peanuts franchise.

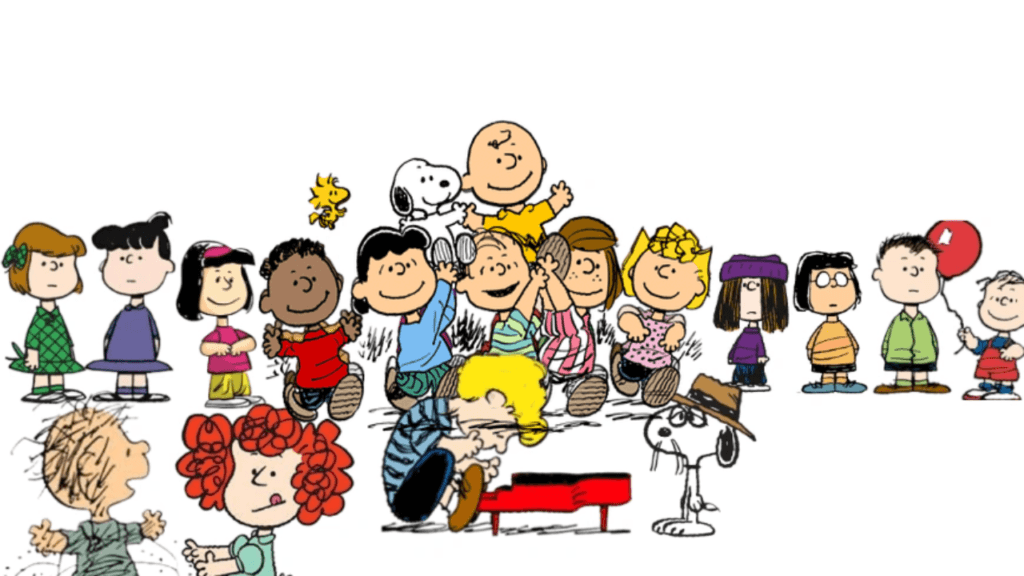

The deal places Sony in a commanding position over the intellectual property created by Charles M. Schulz, which includes iconic characters such as Charlie Brown, Snoopy, Lucy, Linus, and Woodstock. While financial terms have not been publicly disclosed, the agreement underscores the growing value of legacy entertainment brands at a time when studios are increasingly prioritizing long-term intellectual property control over short-term content volume.

Peanuts Holdings LLC oversees the rights and commercial management of the Peanuts universe across film, television, music, licensing, and merchandising. By acquiring WildBrain’s stake indirectly, Sony strengthens its ability to shape the franchise’s future across multiple platforms while stopping short of full ownership — a structure that still preserves existing governance arrangements tied to the Schulz estate.

For Sony, the move is less about aggressive reinvention and more about strategic stewardship. The Peanuts brand occupies a rare position in modern media: universally recognizable, culturally trusted, and largely resistant to trend-driven fatigue. More than seven decades after its debut as a newspaper comic strip, Peanuts remains a perennial presence through holiday specials, publishing, licensing, and carefully curated screen projects.

That longevity is precisely what makes the franchise so valuable in today’s volatile entertainment landscape. As streaming economics continue to evolve and audience attention fragments, studios are increasingly betting on brands with proven multigenerational appeal. Peanuts does not require constant reinvention to remain relevant; its value lies in consistency, emotional familiarity, and a tone that has endured across decades.

Sony’s growing influence over the franchise also aligns with its broader corporate strategy. Unlike competitors racing to launch new cinematic universes, Sony has increasingly focused on owning and managing premium intellectual property across film, television, music, and consumer products. With Sony Pictures handling screen adaptations and Sony Music Japan closely tied to the franchise’s musical and publishing legacy, the company is uniquely positioned to manage Peanuts as a holistic global brand rather than a siloed asset.

Crucially, majority ownership gives Sony greater leverage over creative direction, licensing partnerships, and long-term planning. It simplifies negotiations with streaming platforms, broadcasters, and global partners, allowing for more coherent brand management. However, industry observers do not expect the deal to trigger a dramatic expansion or tonal shift for Peanuts. Historically, the franchise has been guarded carefully, with a strong emphasis on preserving Schulz’s sensibility and resisting over-commercialization.

That restraint is unlikely to change. The strength of Peanuts lies in its emotional subtlety and philosophical simplicity — qualities that do not benefit from constant reinvention or aggressive franchising. Sony’s interest appears rooted in protecting and extending the brand’s quiet cultural power rather than transforming it into a high-output content machine.

For WildBrain, the sale represents a strategic recalibration. The company has spent recent years reshaping its portfolio to focus more heavily on properties it fully owns and controls, as well as its core production and distribution businesses. Exiting a minority stake in Peanuts allows WildBrain to reallocate capital while remaining associated with the brand through existing operational relationships, depending on final deal terms.

The transaction also reflects a broader industry trend: legacy intellectual property is becoming more valuable, not less, in an era of content saturation. While newer franchises often require massive upfront investment with uncertain returns, brands like Peanuts offer stability, predictability, and global recognition — qualities increasingly prized by media conglomerates seeking resilience.

In practical terms, audiences are unlikely to notice immediate changes. There is no indication of a major theatrical reboot or aggressive content rollout tied to the deal. Instead, the significance lies behind the scenes, where ownership structure shapes decision-making power over the next decade rather than the next release.

Sony’s acquisition of majority ownership in Peanuts is a quiet but meaningful consolidation — one that reinforces the company’s long-term commitment to legacy storytelling and measured brand stewardship. In an industry defined by rapid shifts and loud announcements, this deal stands out precisely because of its subtlety. It is a reminder that some of the most consequential moves in entertainment happen not on screen, but in the careful reshaping of who controls the stories that have already stood the test of time.

Read More: